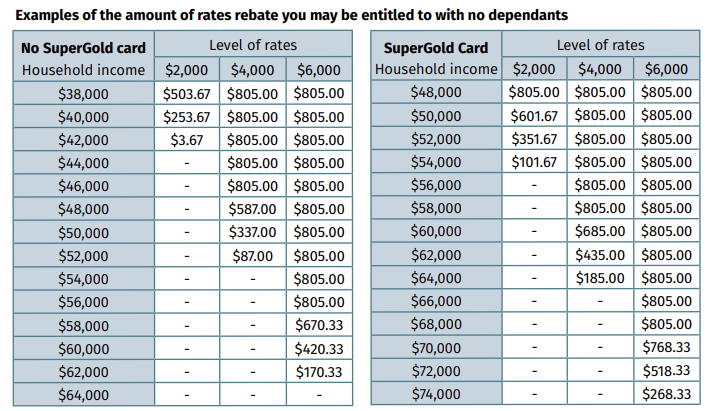

The 2025 Government Budget announced some changes to low-income homeowners applying for a subsidy towards their rates. Income thresholds have been increased, and the maximum rebate is now $805 for the year ending 30 June 2026.

For the first time, SuperGold cardholders now have a different income limit for determining eligibility for the rates rebate.

If you live in a retirement village, including those who live under a ‘licence to occupy’ (LTO) agreement, you should check to see if you are eligible for a rates rebate. There is a separate form that will need to be completed by your retirement village operator and submitted with your rates rebate application form.

The table below may help you decide if it is worthwhile applying for a rates rebate.

To check what your entitlement might be, use the online rates rebate calculator: www.govt.nz/ratesrebatescalculator.